Chipmakers may before long get $52 billion CHIPS Act windfall, but there is a capture

[ad_1]

Chipmakers may before long get $52 billion CHIPS Act windfall, but there is a capture

[ad_1]

In transient: Rebuilding the semiconductor business in the US will not only take time but also a major volume of authorities subsidies for each American and international organizations. A slimmed-down model of the essential laws is now subject matter to the first procedural vote, to ideally get it passed as quickly as upcoming 7 days. Even so, the bill comes with some fine print for organizations that have a existence in China or wish to run there in the long term.

It would not be the to start with time silicon giants warned about the absence of federal government funding for their expansion efforts, but they're after all over again sounding the alarm. Very last month, providers like TSMC, GlobalWafers, and Intel warned that unless Congress unlocks $52 billion in funding for the domestic semiconductor business, they will not likely be ready to execute on their current ambitions.

Thus far, Intel seems like it will be the most significant beneficiary of the new subsidies, as the CHIPS Act is technically meant to aid domestic firms 1st and foremost. That said, sector bodies like SEMI previous year made the circumstance for aiding the better semiconductor ecosystem, which includes many overseas companies that would like to mature their US footprint.

On Monday, US Senate The vast majority Chief Chuck Schumer described the Senate would vote on the issue of federal government subsidies for the chipmaking marketplace by treating it as a different invoice. This would see chipmakers get $52 billion even though telecom firms would get $1.5 billion for 5G community deployments.

Previously, this was component of a bigger, $250 billion bill recognized as the US Innovation and Competitors Act. Pushed by fears that much too substantially of the world wide semiconductor creation will take position in Taiwan, governments are racing to build extra local manufacturing capacity to lower the hazard of long run shocks prompted by trade tensions.

It really is well worth noting the new authorities stimulus for chipmakers arrives with some smaller print. On a person hand, companies like Nvidia, AMD, Qualcomm, Micron, Texas Devices, NXP Semiconductors, GlobalFoundries, and equipment suppliers like ASML and Lam Study could gain from the subsidies, if only as a 1-time celebration. On the other, they would be necessary to refrain from setting up or growing functions in international locations viewed as "unfriendly."

Main amongst these unfriendly nations would be China, which is organizing to lessen its reliance on semiconductor imports as quickly as feasible. Any corporation that desires to extract cash from the $52 billion pool will not likely be authorized to make chips on a 28nm or scaled-down process node in the region.

Some marketplace officers feel this threshold will not make feeling specified the quick speed of progress in method know-how. Samsung recently began creating chips on a 3nm course of action, with TSMC envisioned to stick to in the coming months. Intel is however catching up, but it won't have any official options to make superior fabs in China.

However, the even larger difficulty is that China is paying above $155 billion on the study and growth of state-of-the-art chipmaking technologies. In some areas like NAND producing, Chinese providers such as YMTC are swiftly closing the hole as opposed to other marketplace giants like Micron and Samsung. There is a threat that the $52 billion the US is inclined to invest in domestic capacity developments may well not be adequate.

A different issue is a dearth of skilled employees — a issue that is felt throughout the world wide semiconductor and electronics industries, including locations like Taiwan. Facilitating immigration by students and professional engineers and scientists is 1 way to remedy this concern. A different would be to assistance microelectronics and semiconductor diploma applications this kind of as the just one a short while ago released by Purdue College, or initiatives like the American Semiconductor Academy.

And finally, it appears to be that not all chipmakers are content with the CHIPS Act in its present-day sort. These firms have questioned to be unnamed to steer clear of possible industry and govt blowback, but it would not be far too challenging to guess they are of the fabless variety.

1 these kinds of corporation explained off the report that "you have Intel that may possibly get $20 billion with CHIPS Act plus $5 billion or $10 billion below the FABS Act. So $30 billion goes to your direct competitor, and you don't get a penny? Which is likely to trigger issues in the current market." In other terms, fabless corporations want they could get tax credits for style and design things to do, but they are not holding their collective breath for it to take place at any time soon.

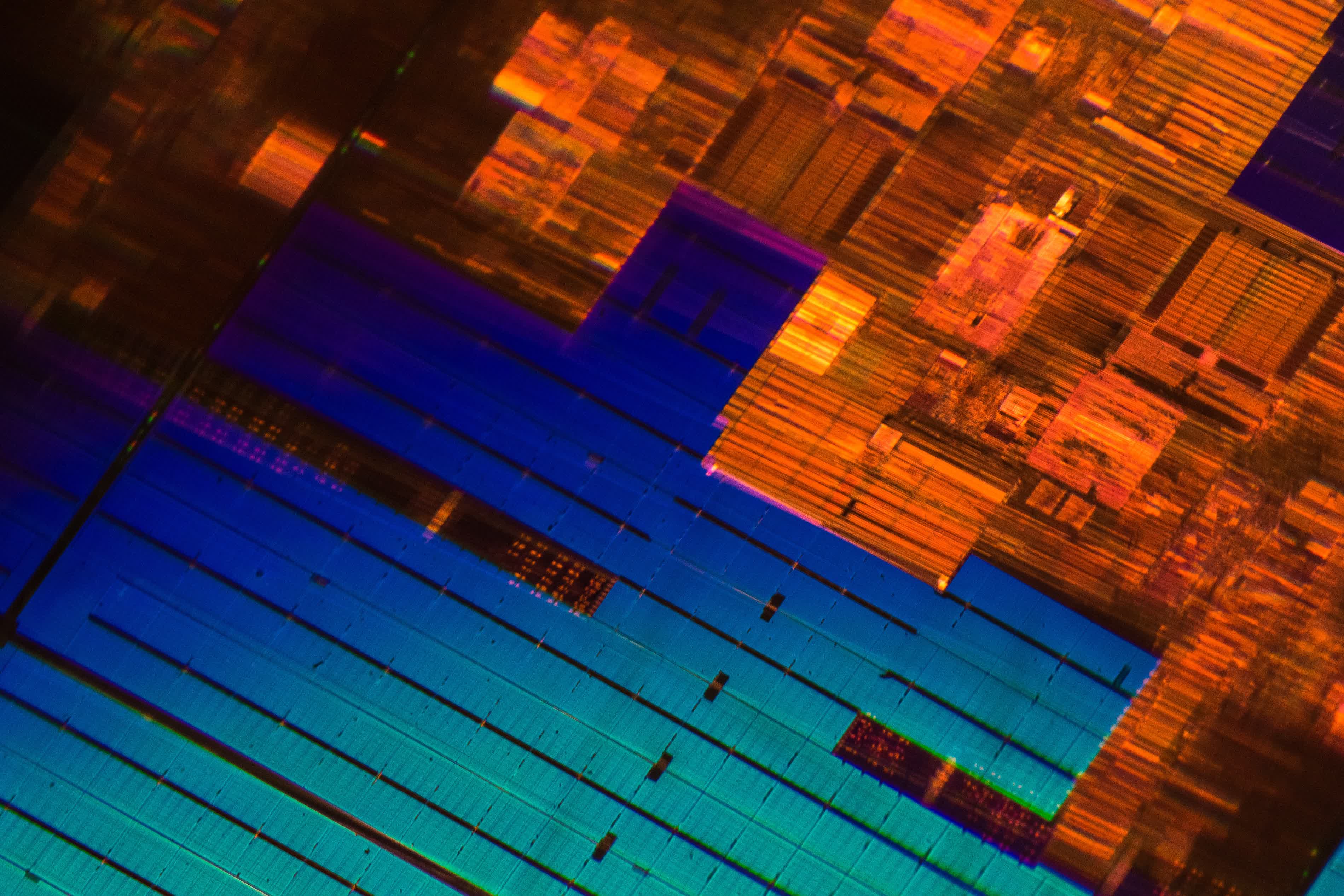

Impression credit score: Jason Leung, Ian Hutchinson

[ad_2]

0 comments:

Post a Comment