Apple will quickly present "higher-generate" cost savings accounts for its Apple Funds benefits

[ad_1]

Apple will quickly present "higher-generate" cost savings accounts for its Apple Funds benefits

[ad_1]

The big image: In situation you weren't having to pay attention, Apple is now a financial institution. I jest, but only a little. It started with the Apple Card, and now the tech large desires to keep your funds, as well. Of system, it is absolutely optional, but it does have some advantages if you are by now an Apple cardholder.

As of May perhaps 2021, there had been 6.4 million Apple Card consumers. Backed by Goldman Sachs, the general company is well-liked for its easy functions, together with Apple Pay back and wallet app integration, genuine-time balances, on-unit account management, hard cash back, and protected card/CVV quantities.

Apple Card has been prosperous enough that Cupertino now would like to hold your personal savings. On Thursday, the enterprise declared it would soon give "high-yield" cost savings to Apple Cardholders.

"Apple announced a new Cost savings account for Apple Card that will allow customers to preserve their Day-to-day Dollars and increase their rewards in a higher-produce Discounts account from Goldman Sachs," Cupertino stated.

Here is how it works. Apple Card is presently established up to give consumers 3 percent back again on Apple buys (in-retailer or electronic) and two % for transactions with taking part sellers like Walgreens, ExxonMobil, T-Cellular, and other folks. All other expenses get a one-% return.

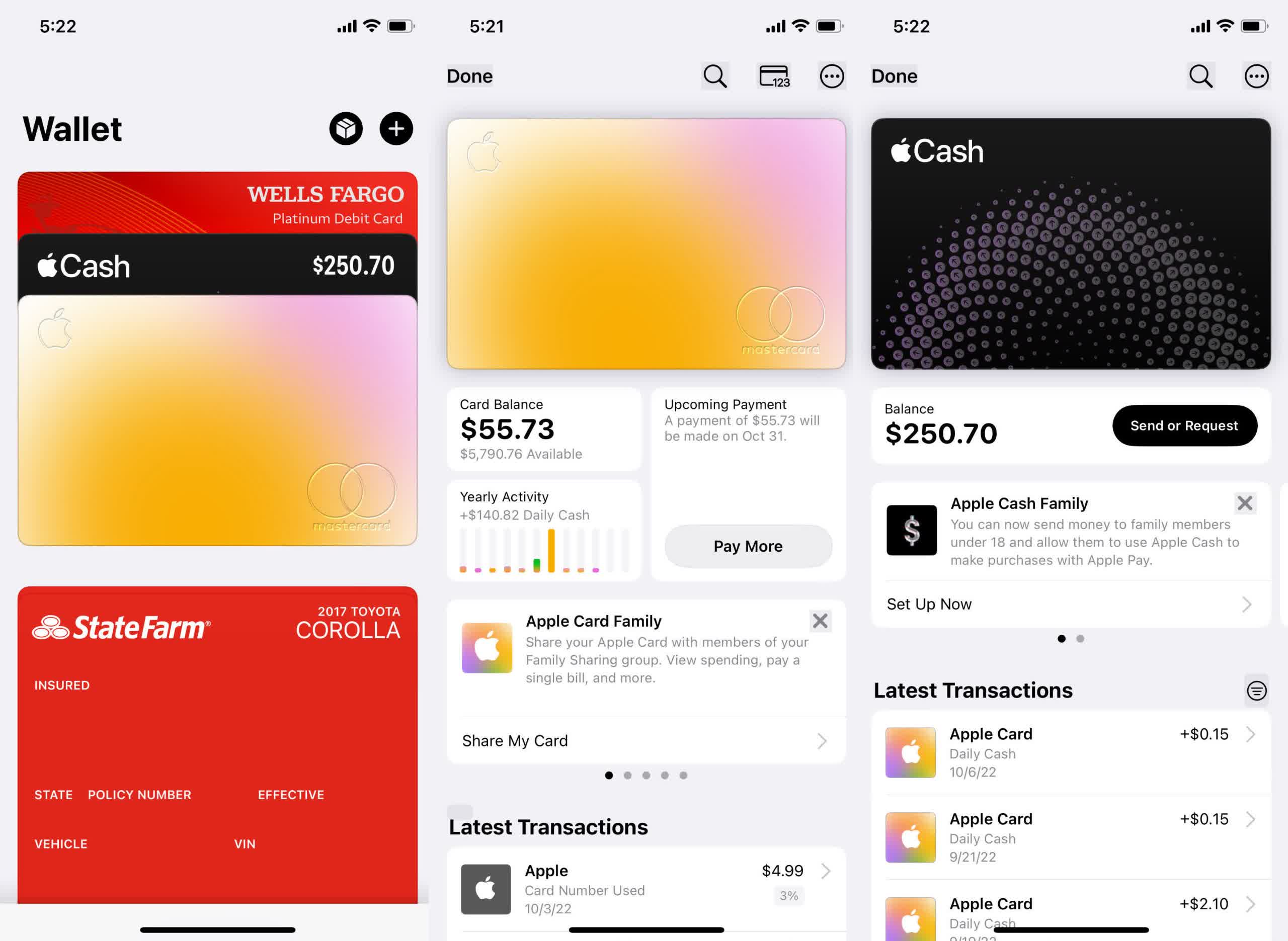

At present, this revenue is saved on a separate virtual card in Iphone owners' wallets termed "Apple Money." It acts like a pre-compensated debit card drawing in opposition to the Apple Income stability. Shoppers can also transfer resources to their standard lender account. In other words and phrases, the funds sits there right until they do a little something with it.

Apple is proposing to put that income into a substantial-yield Goldman Sachs financial savings so that it can receive even extra. As soon as users set up an account, Day-to-day Cash will quickly start out depositing into the price savings as an alternative of Apple Cash. On the other hand, consumers can however choose to have the dollars go into the digital card if they like.

"Buyers can modify their Each day Dollars place at any time," the press launch explained.

Apple failed to outline "significant yield," but anything is far better than nothing, which is what most financial institutions give patrons on savings accounts. The attribute could be another engaging perk for Apple Card prospects if it's truly large-yield, particularly thinking about the few banks that still give interest-baring accounts ordinarily present substantially less than a single percent.

Like all cards saved in the Wallet app, the savings account will have a administration display screen with related options like viewing benefits and other pursuits. Buyers can also transfer resources to and from their attached examining accounts (utilised for generating Apple Card payments), building it like a standard hard cash deposit account, just without the brick-and-mortar lender.

Raising the growth possible of Day-to-day Dollars is a great tiny incentive to established apart a minimal "totally free funds," primarily for all those that hardly ever touch it in any case. It could come in useful for unexpected expenditures or occasional splurging. If it actually is significant-generate, it could even be a better choice than users' present-day price savings accounts. Irrespective, it is challenging to picture present-day cardholders expressing "no many thanks" to extra income, irrespective of the generate.

[ad_2]

0 comments:

Post a Comment