There is TSMC and there's everyone else, can Samsung or Intel capture up?

[ad_1]

There is TSMC and there's everyone else, can Samsung or Intel capture up?

[ad_1]

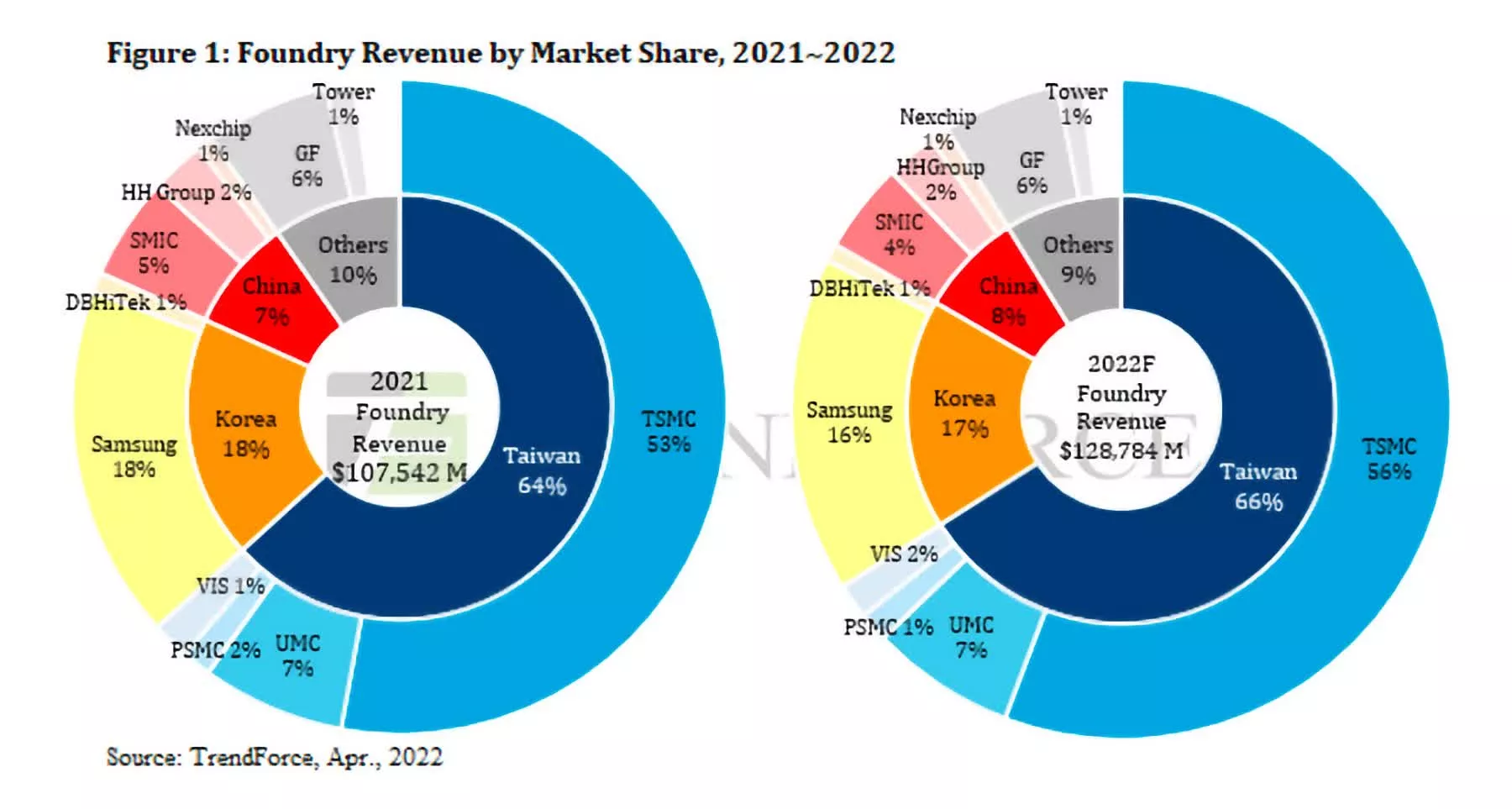

There is only just one company operating at the top edge of semiconductor manufacturing and that is TSMC. Several will browse that and believe "Of system, that's noticeable," but we signify that in a incredibly unique way (several more will study that and then go back to swiping films on TikTok, so thank you for sticking close to...).

For the earlier handful of a long time, there have truly been two firms working at the primary edge -- TSMC and Samsung. With all the consideration that TSMC gets for both equally professional and geopolitical causes, we observed that a good deal of people kind of forgot about Samsung. A number of several years back that would be a error, Samsung was generally competitive with TSMC, if a little little bit slower and more durable to perform with. But it is appears like that may change.

Editor's Take note:

Guest writer Jonathan Goldberg is the founder of D2D Advisory, a multi-purposeful consulting agency. Jonathan has formulated advancement approaches and alliances for companies in the mobile, networking, gaming, and software package industries.

As usual, Dylan Patel has a superior piece on the troubles at Samsung. The speedy summary of that piece is that Samsung is going through delays each for its 7nm procedure and for its DRAM memory merchandise. Browse again on some of the press coverage of Samsung over the past yr, and it appears a great deal like anything is definitely improper there. Delays. False commences. Combined messaging. For us, the eeriest section of this is that this is a pattern we have observed a lot of instances prior to. This is what every single firm appears to be like just just before they tumble off the Moore's Law curve.

To be clear, we are not saying that Samsung is likely to abandon improvement of major edge manufacturing abilities. They have huge assets and know-how. They have to retain shifting forward. But that does not necessarily mean they have to structure their organization the similar way.

More particularly, we have heard a couple of men and women argue that Samsung must exit the foundry small business, end producing chips for other folks and in its place target exclusively on their very profitable memory business enterprise. We know that there are persons in Samsung making this argument, but we have no way to gauge how influential they will eventually be.

This is why it so important to keep in mind Samsung in discussions about foundries. They have furnished an choice to TSMC for several years, but there is a non-zero likelihood that they may no more time give that different. Once more, we are not declaring this is going to happen, but in all our discussions about offer chain resiliency it is significant to recall that issues could actually get even worse.

What would that glance like?

In this article the answer relies upon a large amount on which consumer we are conversing about. Lots of of the premier chip corporations -- notably Nvidia and AMD -- have long in the past moved absent from Samsung for the most section and committed by themselves to TSMC.

They made substantial buy commitments, a method which is now haunting their results. At the other close of the spectrum, practically each individual little startup chip organization we know has never considered working with any person other than TSMC for the major edge.

Samsung's foundry business enterprise is not effortless to function with for compact providers, consumer support is not their crucial offering point. Those businesses are presently living in a planet where by TSMC is the only option, and they are having to pay whole price for that, with yet another 20% bump coming soon. That leaves a significant group in the center, Samsung foundry reportedly has in excess of 100 clients, of which Qualcomm is the most significant. Even however most of these providers possible do the job with TSMC as nicely, getting rid of Samsung as a foundry would lead to a great deal of agony. This would probable mean product or service delays and meaningful price improves -- a.k.a. disruption.

None of this is set in stone. A great deal could modify. Samsung could make the organizational variations it wants to unstick their producing course of action enhancements. They could get subsidies from the Korean and US governments to "really encourage" their remaining close to.

Even more out, Intel could conceivably flip about its manufacturing and then figure out client support. But following two decades of absolutely everyone remaining continually surprised to come across out how brittle the semis offer chain is, now is a very good time for the industry to start undertaking some state of affairs examination and contingency setting up.

[ad_2]

0 comments:

Post a Comment